Our core segments are overnight air cargo; aviation ground equipment manufacturing and sales; commercial jet engines and parts; and corporate and other.

Today the Company is announcing results for the Fiscal year ended March 31, 2023:

• Revenues totaled $247.3 million for the fiscal year ended March 31, 2023, an increase of $70.2 million, or 40% from the prior year.

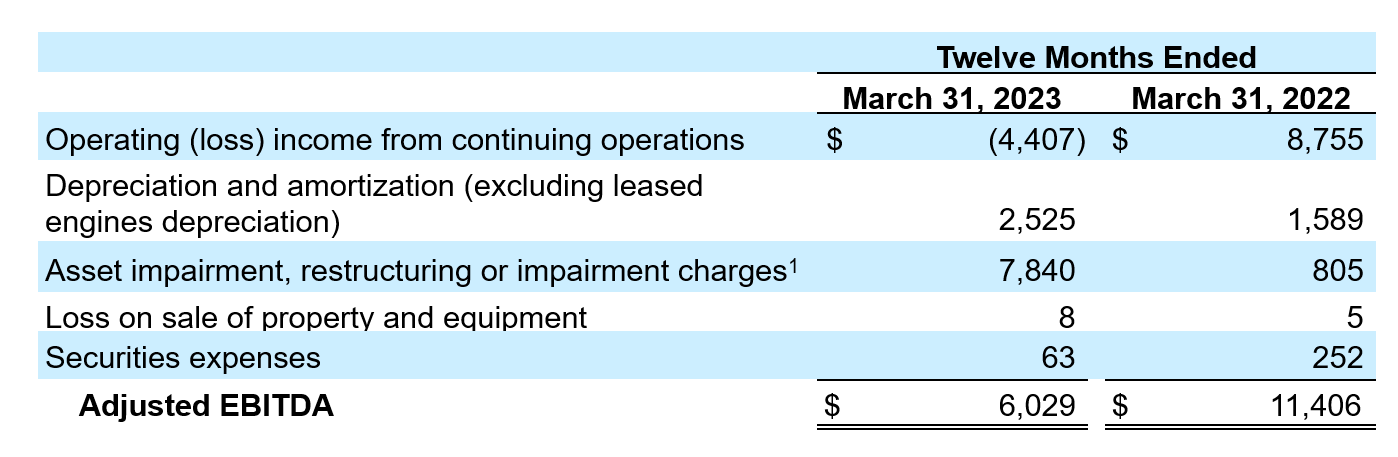

• Operating loss was $4.4 million for the fiscal year ended March 31, 2023, compared to operating income in the prior year of $8.8 million.

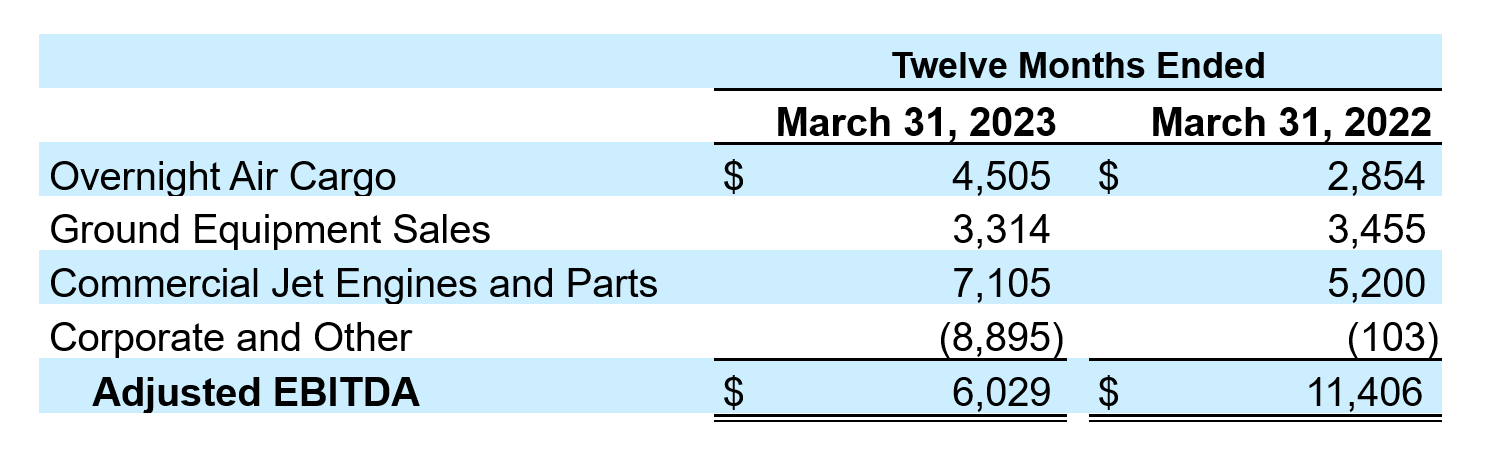

• Adjusted EBITDA* profit of $6.0 million for the year ended March 31, 2023, compared to Adjusted EBITDA* profit of $11.4 million in the prior year.

• Loss per share of $4.32 for the year ended March 31, 2023, compared to income per share of $3.79 for the prior year.

• Total Equity decreased from $24.6 million as of March 31, 2022, to $11.9 million as of March 31, 2023, a decrease of $12.7 million, or (49.5)%.

*Adjusted EBITDA is a non-GAAP financial measure; see below for further explanation and reconciliation to GAAP measure.

Company Chairman and CEO Nick Swenson commented:

“While Air T’s businesses each have their own dynamic, on balance we continue to benefit from the robust state of global aviation. Brief highlights include the following: continued execution at Mountain Air Cargo is resulting in additional aircraft flown; available parts inventories along with a tighter market are driving sales at Stratus and Contrail; aircraft retirement and operational excellence are causing customers to choose Jet Yard; and a great team with thoughtful well-designed software is moving the ball forward at AHT. Yes we are also remembering and planning for the day when the economy slows down, with uncertain consequences for a demand-driven and capacity-constrained aviation market.”

Business Segment Results

Overnight Air Cargo

• On January 31, 2023, the Company acquired Worldwide Aircraft Services, Inc. (“WASI”), a Kansas corporation that services the aircraft industry across the United States and internationally through the operation of a repair station which is located in Springfield, Missouri at the Branson National Airport. WASI is included within the Overnight Air Cargo segment.

• This segment also comprises of Mountain Air Cargo, Inc. and CSA Air, Inc., which provide air express delivery services, substantially all for FedEx.

• Revenues for this segment increased 22% to $90.5 million in Fiscal 2023 compared to $74.4 million in the prior fiscal year, principally attributable to higher labor revenues, higher admin fees and higher FedEx pass through revenues due to increased fleet (72 aircraft in the prior year compared to 85 in the current year).

• Adjusted EBITDA* for this segment was $4.5 million for the year ended March 31, 2023, an increase of $1.7 million when compared to the prior fiscal year, primarily due to the revenue increase noted above.

Aviation Ground Equipment Manufacturing and Sales (“GGS”)

• This segment, which includes the world’s largest manufacturer of aircraft de-icing equipment, manufactures, and provides mobile deicers and other specialized equipment products to passenger and cargo airlines, airports, and military and industrial customers.

• Revenues for this segment $48.5 million for Fiscal 2023, up 15% versus $42.2 million in the prior fiscal year. The increase was primarily driven by a higher volume of truck sales to the USAF and commercial customers in the current fiscal year.

• Adjusted EBITDA* for this segment was $3.3 million in the fiscal year ended March 31, 2023, a decrease of $0.1 million compared to the prior fiscal year.

• As of March 31, 2023, this segment’s order backlog was $13.6 million versus $14.0 million at March 31, 2022.

Commercial Jet Engines and Parts

• This segment leases commercial jet engines and aircraft; buys, sells and trades in surplus and aftermarket commercial jet engines, engine parts, airframes, and airframe parts, avionics, and other; then delivers the related documents and logistics.

• Revenues for this segment totaled $101.7 million in Fiscal 2023, an increase of $44.0 million from Fiscal 2022. The increase is primarily attributable to the fact that all the companies within this segment had higher component sales as the aviation industry started to see more activity in the current year as COVID-19 related restrictions continued to loosen.

• Adjusted EBITDA* for this segment was $7.1 million for the year ended March 31, 2023, compared to Adjusted EBITDA* of $5.2 million in the prior year.

Corporate and Other

• This segment includes expenses attributable to core corporate functions, investment research, and specialized resources that are available to business units.

• This segment’s Adjusted EBITDA* decreased by $8.8 million from Fiscal 2022 to Fiscal 2023. The decrease was driven by an offset to general and administrative expenses in the prior fiscal year as a result of the $9.1 million Employee Retention Credit that did not recur in the current fiscal year.

*Adjusted EBITDA is a non-GAAP financial measure; see below for further explanation and reconciliation to GAAP measures.

Non-GAAP Financial Measures

The Company uses adjusted earnings before taxes, interest, and depreciation and amortization (“Adjusted EBITDA”), a non-GAAP financial measure as defined by the SEC, to evaluate the Company’s financial performance. This performance measure is not defined by accounting principles generally accepted in the United States and should be considered in addition to, and not in lieu of, GAAP financial measures.

Adjusted EBITDA is defined as earnings before taxes, interest, and depreciation and amortization, adjusted for specified items. The Company calculates Adjusted EBITDA by removing the impact of specific items and adding back the amounts of interest expense and depreciation and amortization to earnings before income taxes. When calculating Adjusted EBITDA, the Company does not add back depreciation expense for aircraft engines that are on lease, as the Company believes this expense matches with the corresponding revenue earned on engine leases. Depreciation expense for leased engines totaled $1.6 million and $0.3 million for the fiscal year ended March 31, 2023, and 2022, respectively..

Management believes that Adjusted EBITDA is a useful measure of the Company’s performance because it provides investors additional information about the Company’s operations allowing better evaluation of underlying business performance and better period-to-period comparability. Adjusted EBITDA is not intended to replace or be an alternative to operating income, the most directly comparable amounts reported under GAAP.

The table below provides a reconciliation of operating income to Adjusted EBITDA for the periods ended March 31, 2023, and 2022 (in thousands):

Established in 1980, Air T Inc. is a portfolio of powerful businesses and financial assets, each of which is independent yet interrelated. Its core segments are overnight air cargo, aviation ground support equipment manufacturing and sales, commercial jet engines and parts, and corporate and other. We seek to expand, strengthen and diversify Air T’s after-tax cash flow per share. Our goal is to build Air T’s core businesses, and when appropriate, to expand into adjacent and other industries. We seek to activate growth and overcome challenges while delivering meaningful value for all stakeholders. For more information, visit www.airt.net.

FORWARD-LOOKING STATEMENTS

Certain statements in this Report, including those contained in “Overview,” are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the Company’s financial condition, results of operations, plans, objectives, future performance and business. Forward-looking statements include those preceded by, followed by or that include the words “believes”, “pending”, “future”, “expects,” “anticipates,” “estimates,” “depends” or similar expressions. These forward-looking statements involve risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements, because of, among other things, potential risks and uncertainties, such as:

• Economic and industry conditions in the Company’s markets;

• The risk that contracts with FedEx could be terminated or adversely modified;

• The risk that the number of aircraft operated for FedEx will be reduced;

• The risk that GGS customers will defer or reduce significant orders for deicing equipment;

• The impact of any terrorist activities on United States soil or abroad;

• The Company’s ability to manage its cost structure for operating expenses, or unanticipated capital requirements, and match them to shifting customer service requirements and production volume levels;

• The Company’s ability to meet debt service covenants and to refinance existing debt obligations;

• The risk of injury or other damage arising from accidents involving the Company’s overnight air cargo operations, equipment or parts sold and/or services provided;

• Market acceptance of the Company’s commercial and military equipment and services;

• Competition from other providers of similar equipment and services;

• Changes in government regulation and technology;

• Changes in the value of marketable securities held as investments;

• Mild winter weather conditions reducing the demand for deicing equipment;

• Market acceptance and operational success of the Company’s relatively new aircraft asset management business and related aircraft capital joint venture; and

• Despite our current indebtedness levels, we and our subsidiaries may still be able to incur substantially more debt, which could further exacerbate the risks associated with our substantial leverage.

A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. We are under no obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACT

Air T, Inc. Brian Ochocki, CFO

bochocki@airt.net

612-843-4302

—————————————

1 Included in the asset impairment, restructuring or impairment charges for the fiscal year ended March 31, 2023 was a write-down of $7.3 million on the commercial jet engines and parts segment’s inventory, of which, $5.4 million was due to a management decision to monetize three engines by sale to a third party, in which the net carrying values exceeded the estimated proceeds. The remainder of the write-down was attributable to our evaluation of the carrying value of inventory as of March 31, 2023, where we compared its cost to its net realizable value and considered factors such as physical condition, sales patterns and expected future demand to estimate the amount necessary to write down any slow moving, obsolete or damaged inventory.